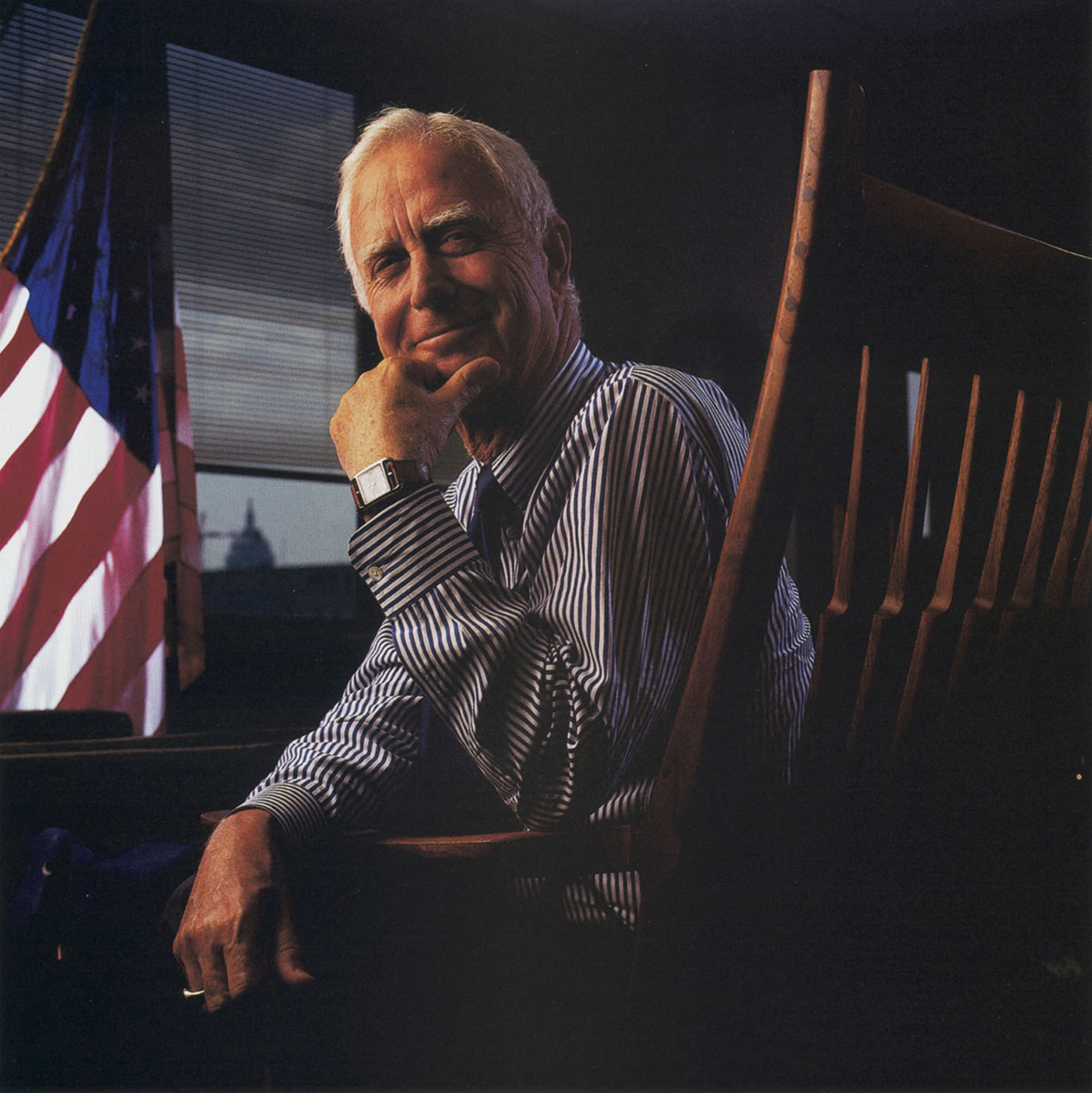

Photo Credit: Peter Tenzer/Minneapolis Fed

Photo Credit: Peter Tenzer/Minneapolis FedThe Society is celebrating the 25th Anniversary of the conclusion of Arthur Levitt’s term as Chairman of the SEC. The longest-serving Chair in SEC history (from July 1993 through February 2001), Chairman Levitt became known for his keen focus on investor protection, and for driving significant change across every facet of the securities industry. He led the SEC with vision and insight at a time of great technological and global transformation.

Throughout his tenure, Chairman Levitt championed individual investors, ethical broker sales practices, timely and accurate corporate financial reporting, fair markets and industry governance that put investors first. His approach was to call out problems impacting investors, and to challenge both the SEC staff and the industry to find ways to address the problem, with both immediacy and creativity. Working with allies and critics alike, the Levitt Commission was highly effective in addressing a wide range of issues and improving investor protection.

At a time when retail investors were just starting to invest their retirement funds in the stock markets and in mutual funds, Chairman Levitt focused on the everyday individual investor. He often invoked his fictional “Aunt Edna,” a novice investor, to illustrate the type of investor who most needed protection. In an interview towards the end of his tenure, Chairman Levitt said "If there is any legacy that I would wish to leave to this institution, it is that this commission respected the interests of the individual investor."

At the end of Chairman Levitt’s tenure, former SEC General Counsel and Commissioner Harvey Goldschmidt reflected: “Arthur has been the longest serving chairman of the SEC, and of far greater consequence to the nation, he has been its best. When he became Chairman in 1993, dramatic economic changes - caused in large measure by technology and globalization - were already in motion… Arthur’s Commission effectively met each of the challenges presented.”

Arthur Levitt came to the SEC with deep experience on Wall Street, including with Cogan, Berlind, Weill & Levitt, later Shearson, Loeb, Rhoades. He was Chairman of the American Stock Exchange from 1978-1989, then Chairman of the New York City Economic Development Corporation through 1993. After leaving the SEC, he co-wrote a book, “Take on the Street: What Wall Street and Corporate America Don’t Want You to Know: What You Can Do to Fight Back.”

Some highlights of Chairman Levitt’s leadership include:

Early in his tenure, Chairman Levitt created the Office of Investor Education and Assistance to help educate investors, answer questions and help resolve problems. He engaged with individual investors in dozens of Investor Town Hall meetings across the country to hear their concerns and educate them about investing wisely. He spearheaded the creation of law school arbitration clinics to help investors resolve disputes with their brokers. To assist investor understanding, he pressed companies to write their disclosures in “Plain English.”

With his experience in municipal securities, Chairman Levitt tackled longstanding problems. The Commission beefed up disclosure, better regulated trading practices, made prices more transparent, and banned “pay to play.” To put greater focus on muni markets, he created a new Office of Municipal Securities. The Commission brought dozens of enforcement actions for “yield burning” by muni dealers and obtained $170 million in disgorgement for investors.

Chairman Levitt made major improvements in trading practices and market structure. Following discovery of widespread abuses, new Order Handling Rules improved execution quality and decimalization improved prices. Regulation ATS opened new venues for electronic trading. Self-regulatory organizations were required to have a majority of independent directors on their boards. The regulation of brokers, advisers, market makers and specialists was stepped up, and a new Office of Compliance Inspections and Examinations strengthened oversight.

After Chairman Levitt raised serious concerns with the quality of corporate financial disclosure and earnings management (1998 speech “The Numbers Game”), the Commission made significant changes in financial reporting, empowered audit committees, improved audit standards and the independence of auditors, and banned selective disclosure (Regulation Fair Disclosure). He championed the independence of audit and accounting standard-setters in the US and internationally.

The Levitt Commission aggressively enforced the securities laws in every area of the SEC’s jurisdiction— against large public companies for financial reporting fraud, against the “Big Five” accounting firms for audit and independence failures, against the NASD and NASDAQ market makers involving price-fixing, the NYSE for lax surveillance and discipline of members, and cases involving insider trading, broker-dealer sales practices and market manipulation (particularly nascent in penny stocks).

At a time when assets under management were growing rapidly, the Levitt Commission strengthened fiduciary fund governance by requiring that a majority of fund directors be independent, mandated improvements in disclosure, drove efforts to reduce fund expenses, banned the use of misleading fund names, and created the “profile prospectus” to help investors better understand and compare mutual funds.

As securities markets were becoming more global, Chairman Levitt expanded relationships with securities regulators around the world, entering into memoranda of understanding for cooperation in cross-border enforcement and examination matters. As offshore companies were seeking access to US markets, he played a pivotal role in creating the International Accounting Standards Board, insisting on rigorous international accounting standards for the protection of investors.

Finally, the SECHS recognizes Chairman Levitt for his original idea to preserve and share the history of the SEC through the creation of a historical society, now the SEC Historical Society, (sechistorical.org).

More information about Chairman Levitt and his tenure at the SEC may be found in the SECHS’s Virtual Museum, including: