“The ‘To Do List’ was the statute.”

~ Phoebe W. Brown, former Special Counsel to Board Member Daniel L. Goelzer and PCAOB Secretary

“The culture at the beginning of the PCAOB was like the Foreign Legion. You had this thing put together, and people came from all kinds of backgrounds. People from the SEC, people from every accounting firm. We had lots of lawyers. We had IT people. Everyone had his or her pedigree. Commonly most of your culture comes out of shared experience or through organization structure or both. We had neither of those things at the beginning. We had a strong mission, but the real way you build culture is to have common experience. We built that as we went along.”

~ Phil D. Wedemeyer, consultant on first limited inspections and first PCAOB Director of the Office of Research and Analysis

The PCAOB officially opened on Jan. 6, 2003 with four Board members and four staff. Initially there was no receptionist, and interviewees and delivery people had to knock until someone, often a Board member, answered.

Charles D. Niemeier was designated the Acting Chair on Jan. 8, and the following day, the Board held its first open meeting in borrowed space at the SEC. In deference to tradition, the Board members did not sit in the Commissioners’ chairs, but presided from tables in front of the dais with printed PCAOB signage to indicate the Board was hosting the meeting. The Board adopted bylaws and announced an aggressive hiring campaign. They set Board level compensation, which Acting SEC Chief Accountant Jackson M. Day indicated should be comparable to other private sector rulemaking bodies like the Financial Accounting Standards Board. The Board also set senior staff salaries, which the Act specified to be “at a level that is comparable to private sector, self-regulatory” staff or management positions. In later years, the high PCAOB salaries sparked criticism and became a source of friction with the Commission. PCAOB Board members have continually maintained they need to offer high staff salaries to attract experienced professionals to go toe-to-toe with the auditing profession.

New employees – all mid career or higher – slowly started to join. They came from the SEC, from private law and accounting practices, and out of retirement. They came without knowing what their salaries or titles would be. But they came for the unique opportunity to build an organization from the ground up.

“We all believed in the mission to protect investors, but I’m not sure we were all in agreement as how to do that,” said Don Marlais, Special Counsel to Board Member Kayla Gillan. “Some came to clean up the profession, some to reign it in, and others to restore its’ integrity.”

The Board and staff easily fit on a single floor of the D.C. headquarters, a vast empty space with offices lining the outer walls, while a public hearing room and formal Board offices were being built on a separate floor. In the temporary space, Nerf football games occasionally broke out, and one hallway was nicknamed the bowling alley. A conference room in the middle of the space was furnished with a single long table; meeting participants had to wheel their own chairs from their offices to the conference room.

“It was a culture of face-to-face conversations because there were so few of us,” said Phoebe W. Brown, former Special Counsel to Dan Goelzer and current Secretary of the PCAOB.

One of the earliest to come on board was Paul Schneider, the first Chief Administrative Officer. A restructuring and startup specialist, he hired the Information Technology, Human Resources, and finance teams. Schneider also managed the $20 million in loans advanced from the U.S. Treasury for salaries, rent and equipment until the Board could establish and collect the support fees to be paid by public companies and other issuers. (1)

Another early arrival was Acting General Counsel J. Gordon Seymour, whom Niemeier had plucked from SEC’s Office of General Counsel. Immediately, Seymour had to tackle both organizational and programmatic responsibilities, including applying for D.C. non-profit status, securing insurance, and writing the Board’s rules.

“Having come from the SEC, an agency that had existed for 70 years, it was daunting to walk into an organization that didn't even have printer paper,” said Seymour. He quickly hired Michael Stevenson, an attorney from the SEC’s Office of General Counsel who had also worked in the Enforcement Division. Stevenson along with Samantha Ross, another SEC alumnus who was Special Counsel to Charley Niemeier, played a seminal role in writing all the Board’s foundational rules. Seymour was named General Counsel in 2007, and Stevenson became his Deputy at that time.

Barbara B. Hannigan, the Ethics Counsel at the SEC, was hired to serve as the PCAOB’s Ethics Officer. She described the culture as “collegial on steroids.”

“It reminded me of freshman year of college,” she said. “There were a lot of new people coming from all over the country and different professional environments, including the Hill, government, private sector, public sector, and academia. Everybody came together to create this new venture and this incredible culture.”

One of the first statutory hurdles fell on April 26, 2003, the date by which the Act mandated the SEC had to determine the fledgling entity had the organizational capacity to fulfill its mission. With scant guidance from the SEC, Dan Goelzer took the lead on designing a presentation outlining the PCAOB’s framework and approach to its programs. Board members and staff worked long hours to develop the numerous components to support the Commission’s determination of readiness including a description of rules it had adopted or would need to adopt.

Borrowing the “St. Patrick’s Day countdown” from the Irish restaurant on the ground floor of the building, Charley Niemeier ticked off a daily “countdown to Determination Day” in the conference room where Board members and staff met each day to discuss progress and make decisions.

It was all hands on deck for the staff. Public Affairs Director Christi Harlan found herself proofreading Rules of the Board; Executive Assistant Cindy Vaughn used her graphics skills to produce letterhead and business cards; and everyone helped to organize and review comment letters that were streaming in on a variety of proposals.

By the middle of April, the Board had issued six proposed rules and adopted two final rules, including its bylaws. As required under the Sarbanes-Oxley Act, the Board submitted each set of final rules to the SEC for its formal approval.

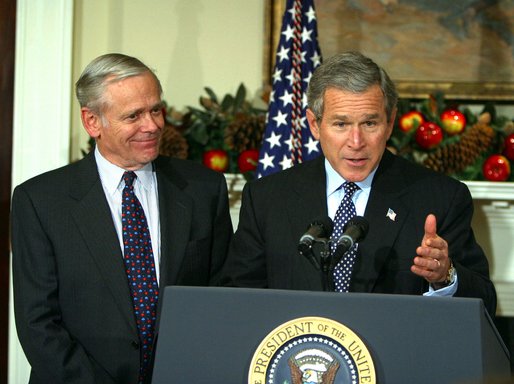

On April 15, 2003, SEC Chairman William H. Donaldson, a former investment banker who succeeded Harvey Pitt in February 2003, held a news conference to introduce the Commission’s unanimous pick for the PCAOB Chairman: William J. McDonough, President of the Federal Reserve Bank of New York. The SEC news release noted that McDonough’s formal appointment would follow “a thorough background investigation.” (2)

The announcement was a surprise to the PCAOB Board and threatened to disrupt its plan to submit the determination documentation to the SEC on April 23.

Suddenly for the SEC, the PCAOB’s bylaws became a sticking point. Written mainly by Kayla Gillan, the bylaws envisioned five egalitarian, equal members functioning like a corporate board of directors. The SEC wanted the Board’s bylaws to set forth special powers for the chairman, similar to the SEC’s own governance.

On the eve of the last day for the SEC to act on determination, neither the Board nor the PCAOB staff could predict the outcome. Several senior staffers retreated to a nearby watering hole to dampen the uncertainty. Meanwhile, the four Board members made their separate ways to an evening reception at the Alexandria home of one of the SEC Commissioners. In the midst of the socializing, some of the Board members forged a compromise with the Commissioners.

On April 25, 2003, the Board convened an emergency Open Meeting at a nearby hotel conference room and introduced new bylaws that incorporated, nearly verbatim, the SEC’s own governance approach. Board Member Kayla Gillan expressed her opposition to the changes, but was outvoted. The SEC issued its positive determination on the PCAOB’s readiness later that day.

After a champagne toast, the 20-odd employees got back to work. A reminder of the last minute complication was memorialized in brass and enamel desk clocks pre-ordered by Jennifer Morrell, Special Advisor to Kayla Gillan, as a gift for each staff member. Luckily the engraved plaques were removable, so the original “SEC Determination Day, April 23, 2003” caption was later swapped out for the correct date.

Although Bill McDonough’s appointment was announced mid-April, he had to wrap up a decade of service as President of the Federal Reserve Bank of New York. He took up his PCAOB post on June 11, 2003, as employee number 42. In the lead-up to the statutory deadline for readiness, the Board had filled several crucial staff positions and begun to make significant policy decisions. Many wondered whether Chairman McDonough would accept or want to revisit decisions made prior to his arrival. According to Samantha Ross, who would later be named McDonough’s Chief of Staff, on his first day the new chairman requested a binder of all the decisions that the Board had made and then retreated to his office to review them. A couple of days later, he asked Board members and senior staff to meet him in the conference room with their chairs.

“I want to give you my opinion,” he said dramatically taking in his audience. “I agree with every decision that you’ve made and I support you.”

With his forceful and charming personality, intellect and stature, McDonough helped establish the credibility of the PCAOB, both domestically and internationally. (3) His strong belief in investor protection and public service took on moral tones when he urged the accounting profession to “restore their reputations and save their souls” (4) and take the opportunity to “seek redemption.” (5) (Chairman McDonough passed away on Jan. 22, 2018, before the SEC Historical Society could conduct interviews with him.)

Early on, the Board created divisions to mirror the key tasks required by the Sarbanes-Oxley Act—registration, inspection, standard setting, and enforcement—and to line up, where possible, with the SEC. Using that structure, the Board and staff sequenced the building of the new regulator.

In an effort to boost transparency and leverage its establishment during the Internet Age, the Board made an affirmative decision to conduct business electronically and make its public documents freely available on line.

“I remember saying to the Board, we don’t need a public reference room like the SEC. It’s all going to be on our website forever,” said Gordon Seymour. “We were definitely under a microscope, and we had to think about every decision we made.”

Dan Goelzer laid out the docket, deliberately diverging from the design used by the SEC. The PCAOB Docket shows the progress of each rule under consideration and locates all materials related to that rule, including releases and SEC filings, under the same docket number.

The Board’s Office of the Chief Auditor, tasked with establishing audit standards, strongly supported the design and championed the easy access it afforded to briefing papers, proposed rules, comment letters, and public meeting records.

“The release documents that surround proposed and final rules are extensive and provide a lot of background on the thought process and comments considered in developing the proposals and final standards,” said Thomas Ray, the first Deputy Chief Auditor.

(1) “Testimony Concerning the Commissions’ Efforts to Strengthen the Accounting Profession before the House Committee on Financial Services,” by SEC Chairman William H. Donaldson, Sept. 17, 2003.

(2) SEC Press Release “Statement of the Commission Regarding the Selection of the Chairperson of the Public Company Accounting Oversight Board (PCAOB),” April 15, 2003.

(3) PCAOB Press Release, “PCAOB Board Statement on Passing of Former PCAOB Chairman William McDonough,” Jan. 25, 2018.

(4) The Financial Times, “The Man Who Put Auditing First,” by Andrew Parker, Nov. 30, 2005

(5) The Fourth Annual A. A. Sommer, Jr. Lecture on Corporate, Securities, and Financial Law, by William J. McDonough, Nov. 11, 2003.