“Owing to what the authors believe to be a “search and replace” word-processing legislative drafting error, SOX actually requires nonpublic broker-dealers to be audited by registered accounting firms. Quite appropriately, beginning in 2003, the SEC issued a series of orders exempting nonpublic broker-dealers from registration with the Board until the Madoff Scandal broke, after which the Commission allowed the last exemption to expire, thus requiring broker-dealers to now be audited by registered firms.” (1)

~The PCAOB’s first Seven Years: A Retrospection by Willis (Bill) Gradison and Ronald S. Boster

“It will be interesting to see how many boards of directors of public companies can comfortably sit on a public company that has a billion dollars in revenue and does not have an internal control audit. That is an essay in corporate culture that remains to be written and research that remains to be done.”

~James R. Doty, PCAOB Chairman commenting on the JOBS Act exempting Emerging Growth Companies from SOX 404 compliance.

In the wake of the Great Recession of 2008, the PCAOB proved it was no longer a startup. With fully functioning divisions and programs, the regulator nimbly was able to build a new oversight regime for another type of audit, those of broker-dealers, after another staggering scandal underscored the need for greater supervision. The legislation Congress passed to respond to the crisis, reform the financial regulatory system, and increase small business activity expanded the PCAOB’s mandate while also curtailing the number of companies that had to comply with Section 404(b) of the Sarbanes-Oxley Act. The regulator also delved deeply into academic research to assess the economic impact of its standards as well as the role of the audit and audit quality in capital formation.

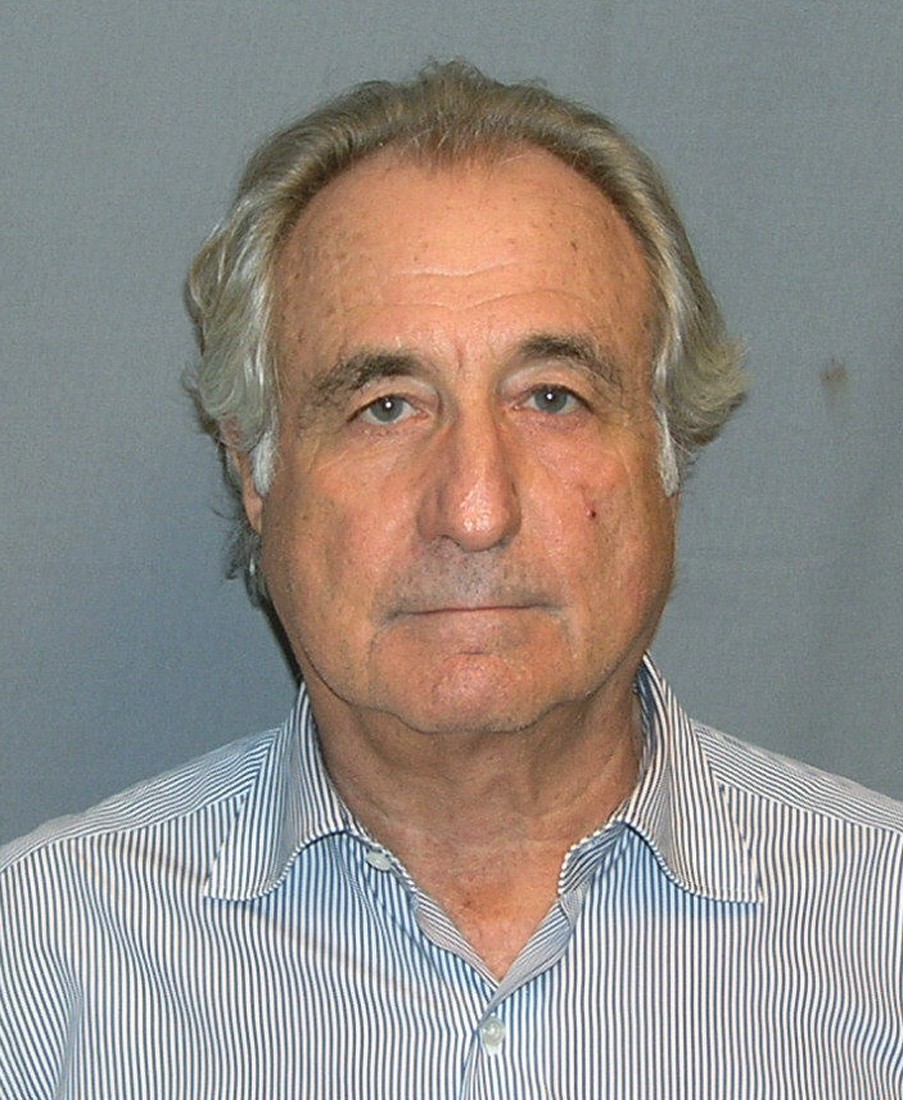

The PCAOB created an entirely new oversight regime including inspection, standard setting, and disciplinary programs for auditors of broker-dealers, after another sensational scandal surfaced in December 2008 in the $65 billion Ponzi scheme run by investment advisor Bernard L. Madoff. A two-person, unregistered audit firm located in a strip mall had rubberstamped Madoff’s financial statements without asking questions for at least 17 years. (2) That firm’s audits had been outside the purview of PCAOB oversight, but that changed with the Dodd-Frank Wall Street and Consumer Protection Act of 2010 (Dodd-Frank Act) which vested the PCAOB with the authority to oversee auditors of the financial statements and selected practices and procedures of SEC-registered securities broker-dealers.

When it was passed in 2002, Title 1 of the Sarbanes-Oxley Act gave the PCAOB the mandate to oversee the audits of securities issuers. However, another provision in Title II, known as a “conforming amendment” inserted word changes into other, pre-existing statutes. By replacing the words “independent public accountant” with the phrase “registered public accounting firm” in the 1934 Securities Act, the Sarbanes-Oxley Act had the effect of requiring nonpublic broker-dealers to use a PCAOB-registered auditor, even though these broker-dealer auditors were not required to use PCAOB standards, and the PCAOB had no authority to inspect their work or discipline them.

Because registration conferred no real oversight authority, shortly after SOX was passed, the SEC issued an order temporarily exempting nonpublic broker-dealers from using PCAOB-registered auditors. The SEC extended this order every December initially, and then every other December until the Madoff scandal came to light. When the SEC let its last exemption expire, nonpublic broker-dealers were required to use auditors registered with PCAOB.

“If Madoff's auditor had been registered with the PCAOB, and yet we hadn't been able to inspect him, or had any real control over him, I'm sure it would have been treated as a black eye for the PCAOB,” said PCAOB Board Member Daniel L. Goelzer. “It might well have been an existential threat to us, the way the Madoff collapse was an existential threat to the SEC.”

After eight years, Congress addressed the gap in oversight by giving the Board the authority to inspect, discipline and write standards for broker-dealer auditors through the Dodd-Frank Act. It did not extend the PCAOB’s authority to include audits of investment advisors, even though much of the Madoff fraud related to his firm’s role as an investment advisor. By 2011, the PCAOB developed an interim inspection program for broker-dealer auditors and inaugurated Forums on Auditing Smaller Broker-Dealers, patterned after the Forums on Auditing in the Small Business Environment, to help smaller broker-dealers throughout the country prepare for the new regulatory regime.

“The PCAOB fully embraced and discharged this new responsibility, which was to understand how diverse and complex the industry was, how many types of audits there are, how they should be inspected, and what should come out of the inspections process,” said James R. Doty, PCAOB Chairman.

The PCAOB’s interim inspection program for brokers and dealers was still in effect as of November 2020. Under this program, the PCAOB continues to release an annual public inspection report summarizing trends and insights, but does not issue individual inspection reports. In addition, the PCAOB uses the program to identify and address deficiencies directly with the firm, and if appropriate, through a PCAOB disciplinary action or referral to the SEC.

Since 2003, the SEC repeatedly extended the deadline for compliance and then finally exempted smaller public companies from the requirement to comply with one of the most contentious provisions of the Sarbanes-Oxley Act. Under SOX Section 404(a), a company’s management discloses its responsibility for and assessment of its internal control structure over financial reporting. Section 404(b) requires a company’s auditor to attest to, and report on, management’s assessment.

The SEC issued rules to implement Section 404 in 2003, but it delayed the compliance date for small companies with less than $75 million capitalization, called non-accelerated filers, to comply with the auditor attestation provision and continued to extend it for many years given the controversy over perceived costs. In 2007, Congress passed the Small Reporting Company Regulatory Relief and Simplification Act, which exempted companies with less than $50 million in revenues or $75 million market capitalization from Section 404(b) requirements.

The Dodd-Frank Act of 2010 later directed the SEC permanently to exempt non-accelerated filers from Section 404(b) requirements and mandated a study on potentially exempting companies with market capitalizations between $75 million and $250 million. The Act excused more than 5,500 small public companies, representing 61% of all U.S. public companies from getting an auditor’s attestation on management’s assessment of the company’s internal controls. (3)

The Jumpstart Our Business Startups Act of 2012, or JOBS Act, created a new category of firm, the Emerging Growth Company (EGC), that is exempted from Section 404(b) for up to five years after going public. The bipartisan law was designed to create jobs and simulate U.S. economic activity by easing many securities regulations and making it easier for EGCs to access public capital markets.

“If Congress says an issuer doesn’t have to have an internal controls audit report, then that’s the law,” said PCAOB Chairman Doty. “The importance of internal controls is, in my mind, undisputed. Really bad things happen when there are poor or no internal controls and the auditor is not inspecting or watching internal controls.”

Sen. Paul S. Sarbanes (D-Md), the co-sponsor of the Sarbanes-Oxley Act expressed “concern about the erosion” (4) of internal control over financial reporting requirements. “You are talking about a company of $700 million in market cap and $1 billion in revenue would be exempt for five years from the application of the 404 financial controls provisions. That in my opinion is a scandal waiting to happen.” (5)

The SEC has continued to carve out exemptions and redefine the terms “accelerated filer” and “large accelerated filer” permitting more companies to avoid the obligation to obtain a 404(b) auditor attestation.

After the controversy that erupted over the implementation of AS 2, there was a call from issuers, business groups, and some members of Congress to conduct cost-benefit analyses of potential standards. The chorus got louder in 2012, after the Board issued a concept release soliciting comment on ways that auditor independence, objectivity and skepticism could be enhanced, including through audit firm rotation, which the Big Four and other corporate interests strongly opposed. (6) At the same time, the SEC was losing cases in the federal courts for not conducting adequate economic analysis on the rules it proposed. (7)

In March 2012, the SEC’s Office of the General Counsel and Division of Risk, Strategy and Financial Innovation (later called the Division of Economic and Risk Analysis) issued Current Guidance on Economic Analysis in SEC Rulemaking to address questions that had been raised about the SEC’s rulemaking process and guide development of new rules. In July 2012, Rep. Darrell Issa (R-Ca.) House Oversight and Government Reform Committee Chairman, and Rep. Patrick McHenry (R-N.C.), Chairman of the Subcommittee on TARP, Financial Services and Bailouts of Public and Private Companies, wrote to the PCAOB to express concern as to whether the SEC’s staff guidance on economic analysis would be implemented by the PCAOB. (8)

“His letter was one of many inquiries that were coming in, it did not surprise us,” said Chairman Doty. “But I did think the PCAOB needed to have credible economic analysis to show that we were fulfilling the requirements and expectations of Congress.”

A follow up letter from Reps. Issa and McHenry, dated Jan. 10, 2013, acknowledged that while the PCAOB was “making concrete commitments to incorporate rigorous economic analysis into PCAOB rulemaking and standard setting,” the committee questioned whether there was “an institutional resistance” to doing so. (9)

The PCAOB responded in two ways. First, in late 2013 the PCAOB announced the establishment of a Center for Economic Analysis to “study the role and relevance of the audit in capital formation and investor protection.” (10) Two prominent financial economists from the University of Chicago were brought on board, Luigi Zingales as founding director and Christian Leuz as advisor. Patricia Ledesma, an economist and former assistant dean at Northwestern, was hired as program leader.

The Center led efforts to use economic analysis to make the Board’s rulemaking, inspections, and other activities more effective. The Center also initiated an economic research fellowship program to foster high quality research for publication in peer-reviewed journals and developed a rigorous post-implementation review to evaluate the effect of significant rulemakings. One research project looked at the effect of engagement reviews in PCAOB inspections on the next year’s audit effort, audit quality and risk of restatement. Another examined the capital market effects of the PCAOB’s non-U.S. inspections. Yet another project looked at whether introducing an element of unpredictability in inspection selection would motivate improvements in audit quality. The Center also co-hosted an annual academic conference with the Journal of Accounting Research.

In addition to establishing the Center, on May 15, 2014, the PCAOB released Staff Guidance drafted by Jacob Lesser of the Office of General Counsel in concert with Ledesma and Andres Vinelli, an economist in ORA, on the purpose, scope, timing and process for conducting economic analysis in PCAOB rulemaking. Rep. Issa released a statement applauding the move.(11)

"The guidance should give those who are interested in the PCAOB's standard setting a better understanding of the analysis that staff plan to conduct to ensure effective and efficient rulemaking,” said Chairman Doty. “The guidance helps us pursue investor protection with appropriate consideration of regulatory burden." (12)

In 2016, the Center commenced the Board’s first post-implementation review, on Auditing Standard No. 7, Engagement Quality Review (codified as AS 1220), by soliciting and evaluating public comment on the standard’s impact since it was adopted in 2009, as well as analyzing inspection and enforcement findings, and other data. The review determined that the standard accomplished its intended purpose without significant cost or unintended consequences.

After standing on its own for three years, the Center for Economic Analysis was merged with the Office of Research and Analysis to create the Office of Economic and Risk Analysis (ERA). The May 2017 consolidation, seen in part as a cost-cutting measure, further integrated the economics and risk assessment staff. ERA performs all the functions of the two offices, including economic analysis and research, risk assessments, and other data analysis to inform PCAOB activities.

(1) Current Issues in Auditing, “The PCAOB’s First Seven Years: A Retrospection” by Bill Gradison and Ronald S. Boster, Volume 4, issue 1, January 1, 2020

(2) New York Times, “Madoff Accountant Avoids Prison Time,” by Matthew Goldstein, May 28, 2015.

(3) Securities and Exchange Commission, “Study and Recommendations on Section 404(b) of the Sarbanes-Oxley Act of 2002 For Issuers with Public Float Between $75 and $250 Million” April 2011.

(4) SEC Historical Society Program, “The Sarbanes-Oxley Act: The First Decade,” George Washington University, July 30, 2012.

(5) Ibid.

(6) Reuters, “U.S. House panel probes audit watchdog’s economic analyses,” by Sarah N. Lynch, Jan. 14, 2013.

(7) New York Times, “The State of Cost Benefit Analysis at the SEC,” by David Zaring, July 13, 2015.

(8) Letter dated July 25, 2012, from Reps. Darrell E. Issa and Patrick McHenry to James R. Doty, PCAOB Chairman. The letter was followed by series of exchanges through early 2013.

(9) Letter dated Jan. 10, 2013, from Reps. Darrell E. Issa and Patrick McHenry to James R. Doty, PCAOB Chairman

(10) PCAOB Press Release, “PCAOB Names Former Kellogg School of Management Assistant Dean Patricia Ledesma as Program Leader for the Center for Economic Analysis,” Jan. 9, 2014.

(11) Press Release, Committee on Oversight and Reform, Issa Statement on PCAOB’s Cost Benefit Analysis Guidance, May 15, 2014

(12) PCAOB Press Release, “PCAOB Releases Staff Guidance on Economic Analysis in PCAOB Standard Setting,” May 15, 2014.

James R. Doty was appointed by the Securities and Exchange Commission as the Chairman of the Public Company Accounting Oversight Board in January 2011 and served until January 2018.